Why Cash Flow Matters

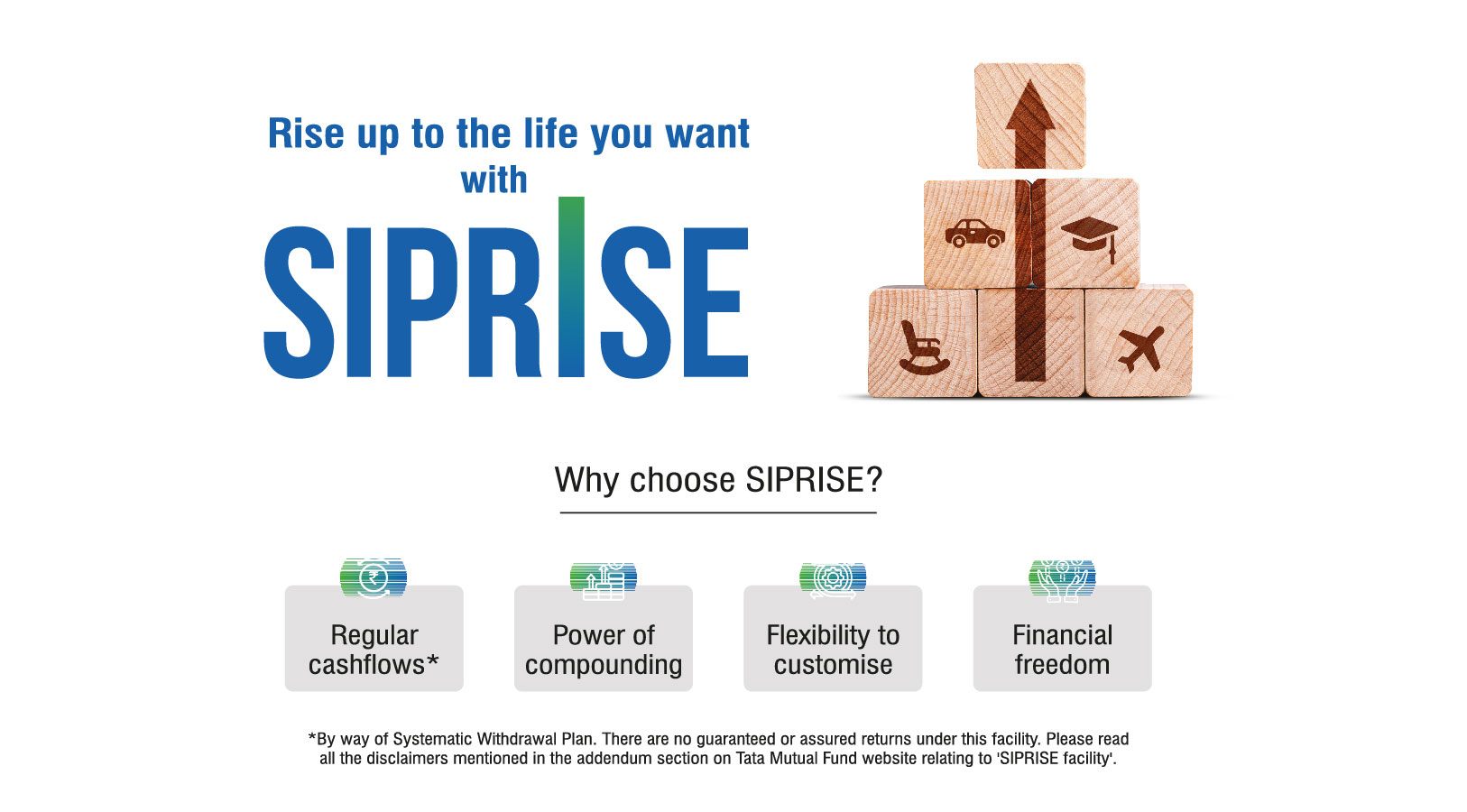

Meet SIPRise

Watch SIPRise in Action

How SIPRise Works

Calculators

Why Choose SIPRise

Why Cash Flow Matters

Meet SIPRise

Watch SIPRise in Action

How SIPRise Works

Calculators

Why Choose SIPRise

SIPRise is a financial solution from Tata Mutual Fund that helps you create a regular source of cashflows through consistent investments via SIP. It offers a unique combination of features, including the flexibility to pause your investment before starting the withdrawal and the ability to transfer the corpus from the source scheme to a target scheme via STP to reduce the impact of market volatility.

With SIPRise, you may achieve your financial goals, whether it's financial independence, retiring early, starting your own business, or simply living more comfortably.

Here’s how it helps to create an additional cashflow:

Watch this video to learn how SIPRise can help you create a regular source of cashflows for your financial goals.

Disclaimer: The SIP is calculated based on monthly compounding. The SWP is calculated based on 15 months withdrawal transfer from Source Scheme to Target Scheme and then 12 months withdrawal is done at the beginning of the month and remaining amount continues to grow at simple annualised basis based on Target Scheme return assumption. Every year at the beginning of the year, from Source Scheme 15 months monthly withdrawal equivalent amount is transferred to the target scheme till the tenure or corpus lasts whichever is earlier. Investment and withdrawal amount computed in multiples of Rs. 1000.